The Business & Finance Institute

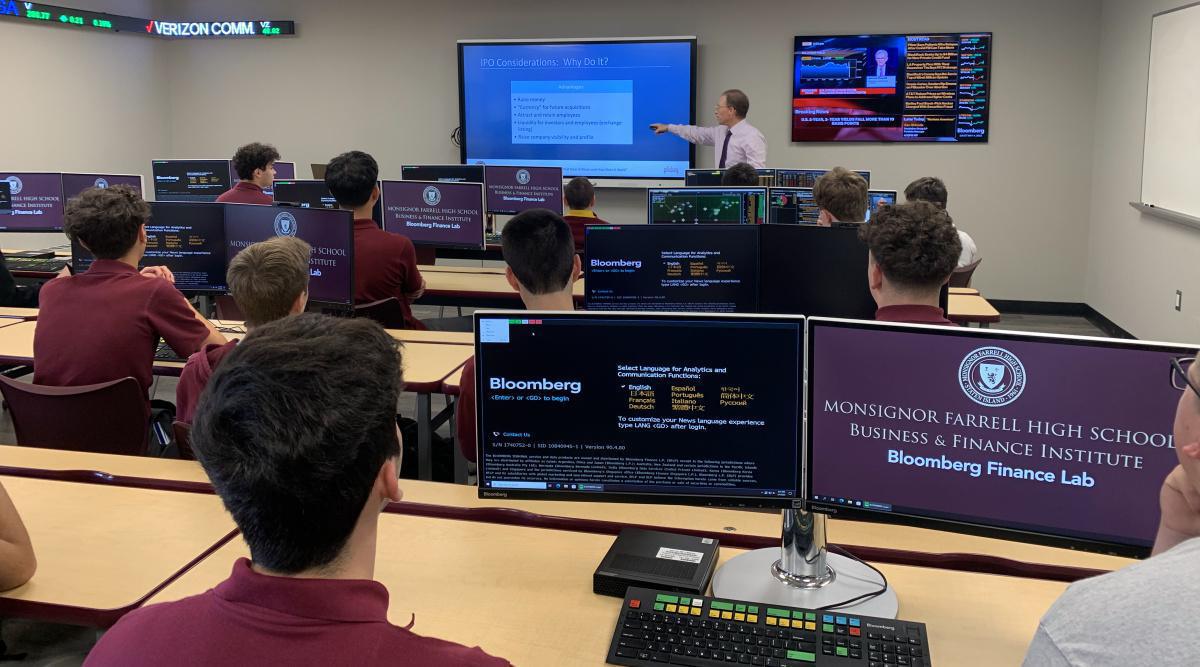

Bloomberg Lab

About the Business & Finance Institute

All Monsignor Farrell students, from freshmen to seniors, are invited to join the Business & Finance Institute

Equipped with 12 Bloomberg terminals — the same technology found on trading desks and research departments of the largest financial institutions in the world — plus a SMART Board, video and teleconferencing technology, a financial library of current periodicals and other business and finance-related literature, and a real-time digital stock ticker, the Business & Finance Institute serves to bring financial literacy to students.

The Business & Finance Institute is one of only two Bloomberg-based programs currently of its size in all of New York City and the first of its kind on Staten Island. On top of supporting curriculum courses in financial literacy, accounting, economics, and business, the Business & Finance Institute serves as the launching pad for extra-curricular programs, including investment clubs and competitions, entrepreneurship workshops, summer business and investment camps, and special programs for local grammar schools and middle schools.

Bloomberg Certification

This is open to all members of the institute from freshmen to seniors. The Bloomberg Terminal is a computer software system provided by the financial data vendor Bloomberg L.P. that enables professionals in the financial service sector and other industries to access Bloomberg Professional Services through which users can monitor and analyze real-time financial market data and place trades on the electronic trading platform. It was developed by employees working for businessman Michael Bloomberg. The system also provides news, price quotes, and messaging across its proprietary secure network.

Bloomberg Market Concepts (BMC), also known as Bloomberg Certification, is a self-paced e-learning course that provides a visual introduction to financial markets and the core functionality of the Bloomberg terminal. It takes ~8 hours to complete and progress is saved automatically. After finishing BMC, Bloomberg provides a "Certificate of Completion".

BMC Modules Required for Certificate:

- Economic Indicators (~1 hour): The primacy of GDP; monitoring GDP; forecasting GDP.

- Currencies (~1 hour): Currency market mechanics; currency valuation; central banks and currencies; currency risk.

- Fixed Income (~3 hours): The roots of the bond market, bond valuation drivers; central bankers and interest rates; the yield curve and why it matters; movements in the yield curve.

- Equities (~3 hours): Introducing the stock market; the nature of equities; equity research; absolute valuation; relative valuation.

Optional BMC Modules:

- Terminal Basics (~2 hours): Using the terminal; analyzing the market; exploring the equity market; discovering the fixed income market; building an equity portfolio.

- Commodities: Intro to commodities; commodity fundamentals; commodity players; commodity training.

- Equity Options: Intro to stock options; using the language of the options market; the role of a stock options trader; basic multi-leg strategies.

- Portfolio Management (~2 hours): Defining a portfolio manager; generating ideas; building an equity portfolio; analyzing a portfolio; assessing portfolio risk.

Alumni Guest Lectures & Discussion Panels

Accomplished alumni return to campus as guest lecturers, engaging the students in topics related to investment banking, portfolio management, private equity, cryptocurrency, real estate, entrepreneurship, and more.